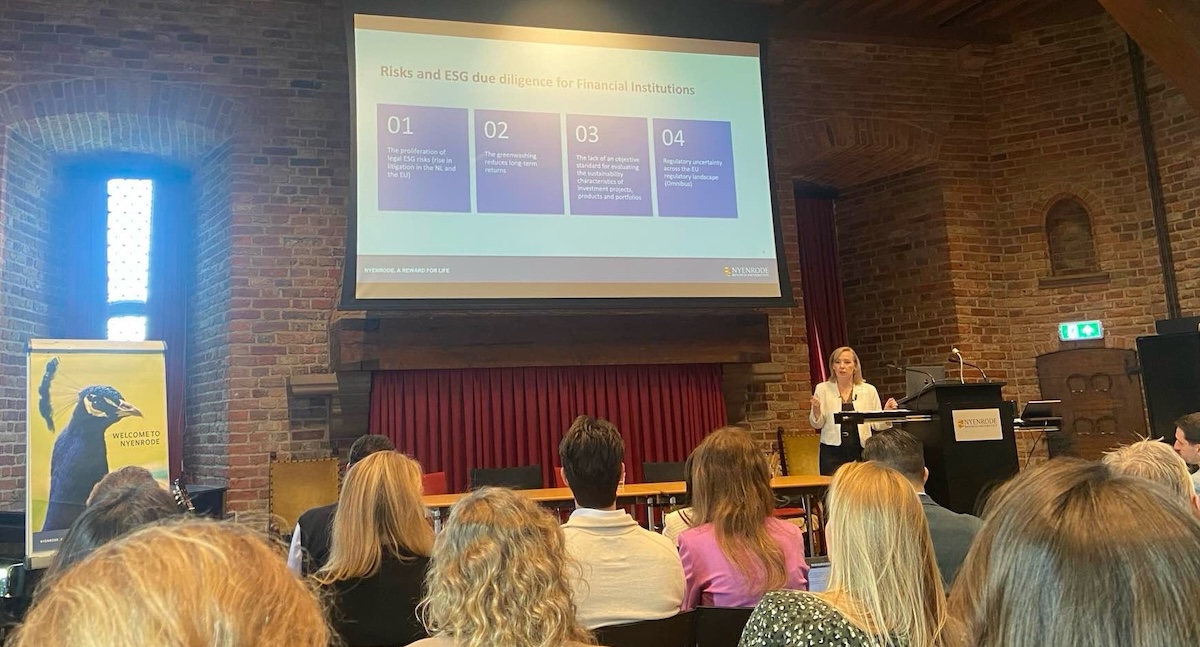

On April 3, 2024, legal experts, policymakers, and institutional investors gathered at the Nyenrode Castle for the very first Research Round Table Event. The goal of the event, organized by Dr. Yulia Levashova and fundraiser Christina Ceulemans, was to jointly explore the evolving ESG landscape within the financial sector.

Micky Adriaansens, Chair of Nyenrode, emphasized the importance of ESG due diligence in all forms of investment decisions. The panel discussion provided valuable insights into the role of ESG within the financial sector and foreign investments.

Regulation as a driver, not a burden

A key takeaway from the discussion was that ESG regulations should no longer be seen as a burden but as a strategic tool. By leveraging regulation as a driver, financial institutions can make better investment decisions while simultaneously increasing their societal impact. The importance of supporting SMEs in this transition was also highlighted.

ESG data: indispensable, yet lacking

A frequently discussed challenge was the quality and availability of ESG data, particularly concerning social impact and human rights. The sector heavily relies on external data specialists, but the coverage and reliability of this data often fall short. This limits the ability to properly assess risks and effectively steer toward societal goals.

Challenging DEI measurement

Panelists also pointed out the difficulty in measuring diversity, equity, and inclusion (DEI). In some regions, political headwinds put pressure on these values, making it challenging to establish consistent and reliable DEI metrics. This poses a risk for institutions aiming to promote transparency and inclusivity.

ESG due diligence as part of treaties

ESG obligations, such as due diligence, are increasingly being structurally integrated into international investment treaties. The Dutch Model BIT is a current example. These kinds of treaties are designed to ensure a level playing field where foreign investors are also held accountable for their social and ecological impact.

Research into fragmentation in practice

The second part of the event focused on a research proposal by Yulia Levashova (Nyenrode Business University), aimed at addressing fragmentation and operational gaps in ESG due diligence within the financial sector. Her research aims to provide practical guidance for institutions that want to apply ESG in a comprehensive and effective manner.

The second part of the event focused on a research proposal by Yulia Levashova (Nyenrode Business University), aimed at addressing fragmentation and operational gaps in ESG due diligence within the financial sector. Her research aims to provide practical guidance for institutions that want to apply ESG in a comprehensive and effective manner.

For more information about this research, click here. Interested in supporting this research financially? Please contact fundraiser Christina Ceulemans at c.ceulemans@nyenrode.nl.

Related programs

-

Modular Executive MBA in Business & Sustainable Transitions

Start date: spring & autumnLanguage:- Dutch

Location:- Breukelen

The Modular Executive MBA in Business & Sustainable Transitions focuses on transitions underway around sustainability.

View program

-

Executive Programme Energy Transition and Innovatione

Start date: March 24, 2025Language:- English

Location:- Breukelen

Get ready for the future of energy – with Nyenrode Business University, RWTH Aachen University of Technology and the International Energy Agency

View program

-

Executive Programme Energy Transition in Business and Leadership

Start date: 17 November 2025Language:- English

Location:- Amsterdam

This executive programme focuses on the development of new business models at a time of massive and disruptive change in the energy market. It has three main parts.

View program

-

Executive Programme Hydrogen

Start date: 1 July 2025Language:- English

Location:- Breukelen

In the dynamic world of the energy transition, the Executive Hydrogen Programme emerges as a platform for leaders in the hydrogen sector.

View program

-

Executive ESG Program

Start date: To be determinedLanguage:- English

Location:- Breukelen

The latest ESG knowledge and insights to transform your organization and be able to increase your positive impact on people, planet and society.

View program